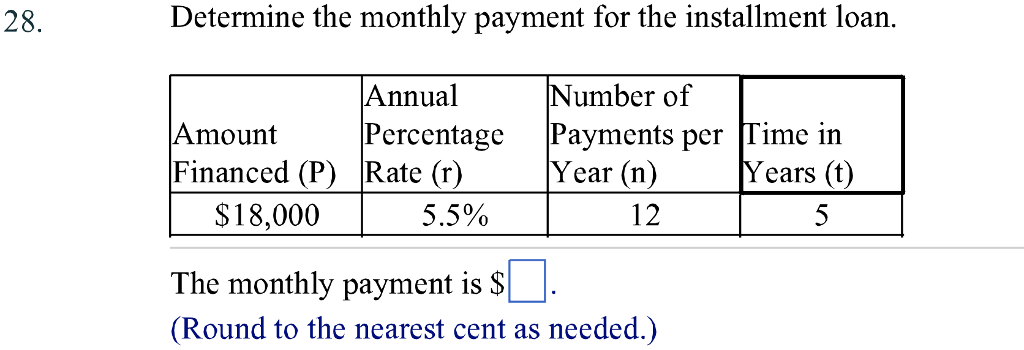

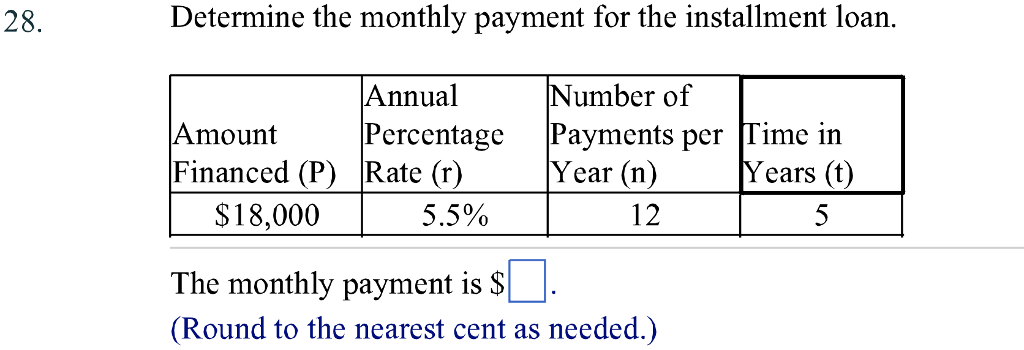

What is a Monthly Installment Loan

A monthly installment loan is a fixed-rate debt product that enables you to borrow money and pay it back in installments over a predetermined period. These loans can help you manage your debt better and save you money in the long run.

These types of loans are a great option for many Americans who need to borrow money. Understanding how they work and what factors affect your rate will help you make the best decision for your needs.

Benefits

Installment loans are a popular choice for many consumers because they offer a predictable schedule of monthly payments. They are also a great option for consolidating debt, especially if you have multiple high-interest loans.

These loans can be a good fit for borrowers who have a stable income and a credit score above 600. Making on-time payments to these types of loans may improve your credit score, and they can also help you get approved for other types of credit.

They can also be a good choice for borrowers who are looking to broaden their credit mix, which is a credit score factor that considers the types of accounts you have. If you primarily used credit cards in the past, getting an installment loan may help you increase your overall score by adding a positive payment history to your credit report.

Another benefit of installment loans is that they are a better option for financing big purchases than using revolving credit, like a credit card. With a fixed interest rate and regular payments, you’ll be able to budget for your debt more effectively than with revolving credit.

Interest rates

An installment loan is a type of credit that gives you an upfront lump sum and lets you repay it in fixed monthly payments. These loans are popular because they provide stability compared to other types of debt.

Installment loans are available from traditional lenders such as banks and credit unions, as well as online lenders. They’re typically used to finance large purchases, like a car or home.

Interest rates are an important factor to consider when choosing an installment loan. The interest rate you pay on your installment loan will affect how much you pay each month, and it also will impact the total amount you owe over time.

It’s helpful to shop around and compare rates offered by various loan companies before you make a final decision. Many lenders offer pre-qualifications, which allow you to review offers without affecting your credit score.

Repayment periods

Installment loans allow you to borrow a fixed amount of money over a set period of time. This can make them a great option for big purchases like new homes or cars.

They are also a good way to build credit and strengthen your credit history. Your payment history makes up 35% of your FICO score, and on-time installment loan payments help boost that rating.

Aside from that, most installment loans have fixed interest rates, so you know exactly how much you’ll be paying each month. This can make them easier to budget for and less likely to be an unwelcome surprise.

Installment loans are a popular choice for many people because they’re predictable and easy to repay. This is especially true if you’re on a tight budget.

Convenience

If you’re looking for a loan with predictable monthly payments and fixed interest rates, monthly installment loans may be a good choice. Installment loans can be used for a variety of reasons, including to pay for unexpected expenses or as a way to strengthen your credit score.

Convenience can refer to a wide range of things, from the ability to find something easily to the convenience of paying with one particular method. In general, consumer goods that are widely available and relatively inexpensive are considered convenience goods.

The cost of purchasing a convenience good depends on price elasticity of demand, which measures how frequently consumers buy or exchange the goods in question. This helps to keep the market competitive and ensure that a given good remains in demand.

If you’re tempted to use a convenience check as a way to pay a bill or borrow money, think about whether you really need the money. If you do, it could be cheaper to access your checking account or savings instead.